Open 24 Hours: Bringing the full Capabilities of the Bank Branch to Digital channels

2 min read

In my previous blog I presented the idea that Financial Services firms are now expected to operate and be “Open 24 Hours,” and that underlying this is their transition from a physical to digital business model.

This post will build on this principle by exploring the factors that are driving this change and some of the challenges that need to be addressed.

The explosion of digital devices, mobile apps, Wi-Fi everywhere, cloud computing and broadband Internet is providing consumers with increasing ways to explore and shop online. With increased use, shopping and buying online is fast becoming the normal approach, especially with younger consumers.

Increasingly, Canadians start their purchasing journey in the digital space – primarily on the Internet. This initial step is usually preceded by a referral by a friend, colleague or family member based on a superior experience. Typically the trend for consumers, especially in the retail industry, is to shop online and purchase offline.

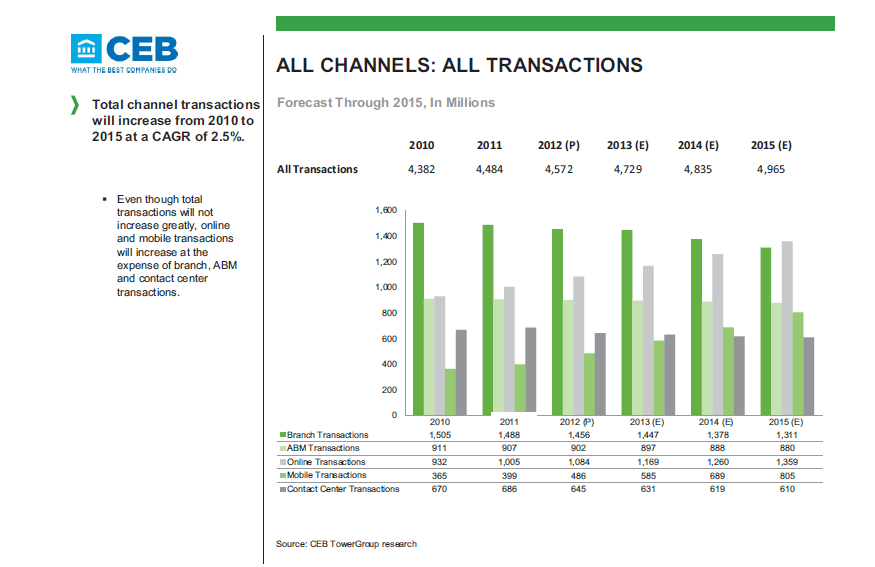

How is this manifesting for retail banks? Just look at the forecasts of usage patterns and changing transaction mix across retail banking channels. Recent industry surveys all confirm that the volume and mix of transactions is forecasted to change over the next 5 years. The Internet and mobile channels are increasing in usage, while the branch channel is expected to remain flat or, in developed markets, expected to decrease. In addition, the nature and type of transactions traditionally completed in the branch is shifting to the digital channels as more technology-enabled solutions are deployed.

All new innovations start out with limitations, and quickly become more robust over time. Customer expectations also increase as these innovations become mainstream. And so too it is with Canadians who are now beginning to expect that they can complete all banking transactions – that is purchase online – over digital channels just as they are able to do in the branch.

With more Canadians choosing to engage through digital channels, retail banks need to work through the challenge of bringing the full range of service capabilities in the branch to mobile devices and online.

With the power of when and how to interact shifting to the consumer, retail banks must deal with new logistical challenges. For example, how do we structure and staff to deliver services in a 24 hour / anytime operating model? How do we ensure that the customer experience is superior and consistent regardless of the channel they choose to initiate the interaction with our bank? How might we be able to transact in every channel vs. just at the branch? How might we ensure that we have the right resources / expertise at the point of interacting which is now controlled by the customer? How do we optimize operating cost while expanding the operational footprint?

Source: CEB Tower Group Financial Services Channel Transaction Volumes – Canada – March 2013

The good news is that the technology of today, and the near future, will create new and more options for how banks overcome these challenges. But it is important to note that the operating model and logic for service delivery and distribution must be reconceived based on the new capabilities that current and emerging technology innovation brings.

My following blogs will explore how retail banks can begin to develop the capabilities enabled by technology to address the operational and logistical challenges inherent in operating in a customer-driven 24-hour world. Stay tuned.