We’re on the cusp of the fourth industrial revolution. If the internet of things scratched the surface, the internet of everything will fundamentally change the way we work, live and play. Risk management, like Blade Runner, is about to get its big reboot.

The amount of data associated with the internet of things (IoT) will grow 3.8-fold globally by 2019. Insurers are tasked with pinpointing value in all that data before it’s lost. Like tears in rain.

Why is IoE Technology Such a Game Changer for Insurance?

Take the premise on which insurance has operated for over three hundred years. Uberrima fides, or ‘Utmost good faith’ — the expectation of the insured customer to disclose all facts material to the risk. Insurers combine facts to create risk statistics, pool the risk and price it.

Contrast that with a new wave of smart insured assets, each able to disclose (at least) its own status constantly.

IoE disruption will make risk management more contextual.

That’s not to say IoE spells the end of the traditional insurance sector and the insurers that operate within it. Nor to discount the vital roles of insurers, whose unique capabilities and underwriting skill cannot easily be substituted. Not to mention huge customer bases, commitment to established industry-wide initiatives (e.g ELTO and MID), financial reserving to meet long-tail claims (e.g. asbestosis/mesothelioma and industrial deafness); established brands, a deep understanding of risk, and the general knowhow to operate a profitable business in a complex and highly regulated environment.

Risk Management Implications

The IoE could present insurers with lots of new risk management opportunities.

IoE tech might allow insurers to offer true usage-based cover, with premiums adjusted in real-time, according to the risk posed. For example, motor premium based on the hours that a vehicle is detected to be parked and locked in a garage.

Think what sprinklers have done for fire risk in Commercial Lines and multiply the possibilities. Where radio frequency ID (RFID) tags have already proven invaluable to insurance inspection, the implication for even smarter sensors is even more significant.

Smart sensors will better detect abnormal temperatures or voltage levels. Sensors linked to actuators will detect a property flood and automatically shut off water and electricity to minimise damage. Machinery will warn of its own potential failure and avoid unexpected production gaps, spoiled materials, costly equipment repairs or even total loss scenarios.

In Personal Lines, smart tagging of personal possessions is becoming more commonplace. Growing use of IoE sensors in vehicle, property and wearable tech means that many potential claims can be minimised or even avoided completely. There are already growing numbers of vehicles on the roads that feature advanced driver assistance systems (ADAS), which eliminate most low speed collisions.

Flood and Energy

How about tackling two of the UK’s biggest issues? Everyone’s got their own ideas about flood prevention — more upstream foliage and front gardens set to lawn. Reintroducing beavers has even been suggested. Insurers could certainly do with more than having to ask successive governments not to allow construction on flood plains, and having to share the costs (anyway) through Flood RE.

“If weather stations automatically talked to river barriers, sensors, storm tanks, and flow metres; this could result in drains opening or closing, or just diverting the water flow. The possibilities are only limited by our imagination.” — Dr Alison Vincent

Could IoE hold the answer? Early warning systems help but imagine a system of smart pumps, sluices, gutters and channels. Imagine excess water could be turned into energy using water as a battery in smart energy grids and a sharing economy.

Far fetched? Maybe. Expensive? You bet. Would it cost more than the annual flood clean up?

From IoT to IoE

In light of relatively disappointing take up of some IoT-based insurance offerings launched so far, the industry is sometimes (and unfairly — this is the sector that pioneered telematics) perceived as being slow to respond and adopt new technology, when it’s perhaps more so the customer.

The complexity of quantifying the investment and effort needed to play in a nascent and uncertain market, particularly with sometimes competing imperatives (of service, profit and compliance) means many are maintaining a watching brief or implementing a basic IoT offering until such time as the market direction becomes clearer.

However, this stance does carry risks. Namely getting left behind or getting it wrong.

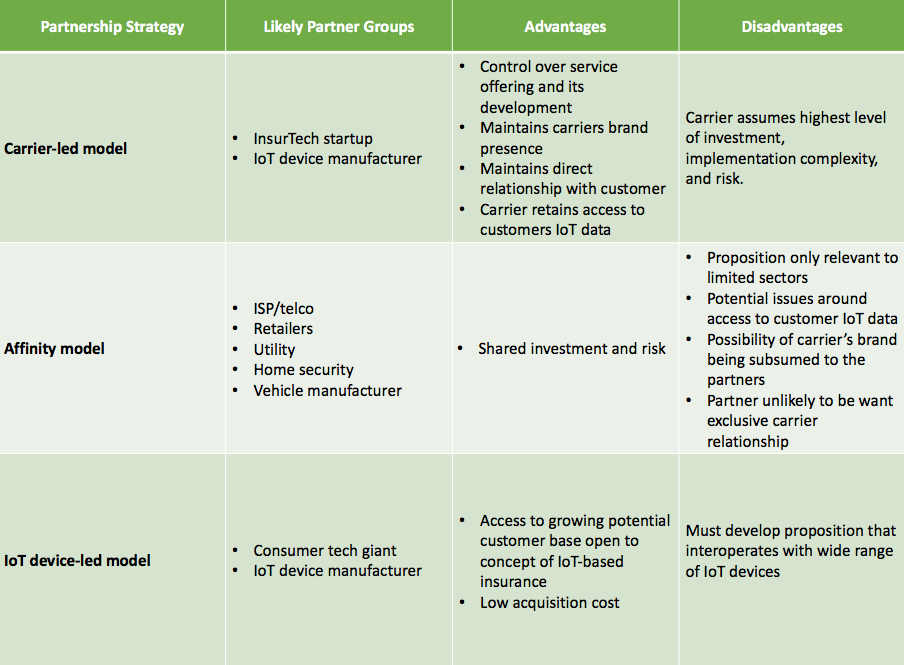

An IoE Insurance Partner Ecosphere

To seize IoE opportunities while managing risk requires insurers to embrace a partnership ecosystem.

Let’s #CiscoChat

Do you agree? If you’re interested in how technology is changing insurance, please share your thoughts with fellow InsurTech enthusiasts in our forthcoming Twitter #CiscoChat.

Worry Less Innovate More

If an increasing cyber-attack surface worries you, Cisco Umbrella is the solution for security beyond the firewall and threat analytics for the Internet of Everything.

Technology and digitisation is changing the world, and having built the global enterprise network, Cisco is at the heart of it. Because the network is connecting it all.